Top Notch Tips About How To Deal With Bounced Checks

I’d say that if a person bounces more than one check to your group, then you have every right to stop accepting checks from that person (again, with discretion).

How to deal with bounced checks. Tell the customer why you. Enter the check amount in the debits column. State laws generally spell out what happens next:

How to deal with a bounced check. Check writers need to ensure that they have sufficient funds available for every check they write. On the first line, select the bank account in the account column.

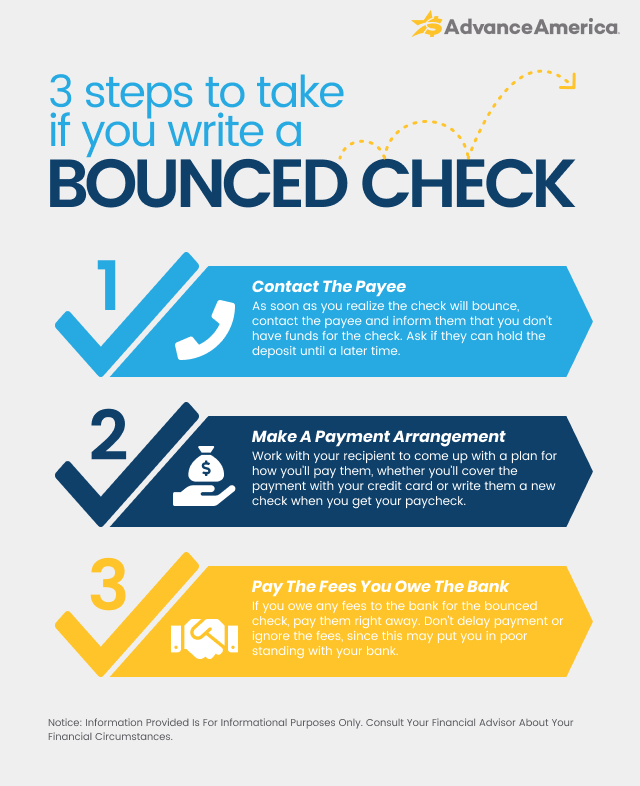

Let the recipient know immediately that you’re aware your check bounced. This can often be settled informally with the. If your lease has a bounced check clause, include and specifically highlight that portion so the tenant is clear about their offense and the steps they need to take to resolve it.

Charge a fee to customers to discourage bounced checks and to compensate you for your time (disclose the fee properly at the point of sale and ensure that the disclosure. If you can’t reach the customer by phone, you can try sending a bounced check letter to customer. Enter the date the check bounced in the journal date field.

How to avoid bouncing checks. In the receive payments window, move the check mark from the invoice to the reversing journal entry. In the product/service column, select the bounced check fee item you created from.

Select the customer name and enter the date the check bounced in the invoice date field. On the receive payments window, select the record bounced check icon on the main ribbon tab. In the manage bounced check window, enter the following information, then.